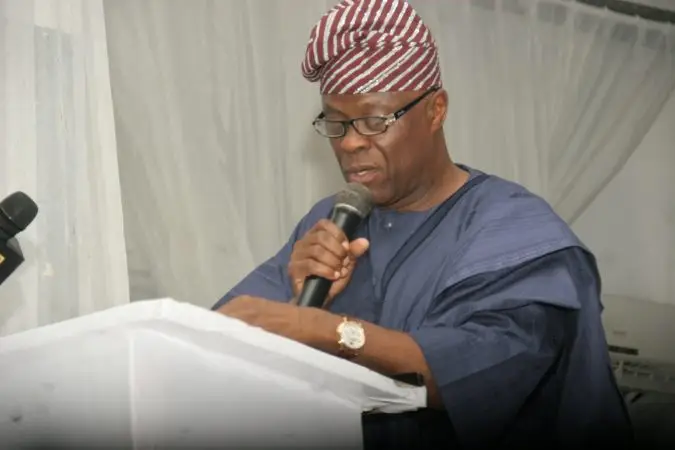

The Finance Minister and Coordinating Minister for the Economy, Wale Edun, has explained why the Federal Government is embracing Islamic Finance.

The minister said the world can no longer afford the “elevated high levels” of interest-based financing.

Edun stated this at a programme organised in Abuja by the Security Exchange Commission (SEC) and the Islamic Financial Services Board (IFSB).

The minister noted that man-made and natural shocks that have pushed rates sky-high, adding that development is also constrained by the soaring cost of borrowing.

Edun stressed the detrimental impact of high interest rates, saying, “make it impossible to access the funds needed for development, infrastructure, and even social services.”

Highlighting the crippling effect, he listed infrastructure, education and healthcare as some of the vital areas suffering under the burden of exorbitant borrowing costs.

Offering a potential alternative, Edun drew attention to a recent $30 million grant from the United Arab Emirates (UAE) dedicated to climate action and adaptation in Nigeria.

He said, “Notably, this grant was funded through Islamic finance principles, hinting at a shift in the landscape of available resources. Clearly, funds these days are with those who practice Islamic finance. You better follow the money.”

He urged deeper understanding and utilisation of Islamic finance, calling it “a veritable tool for financing development” endorsed by the IFSB.

Edun stressed the imperative of harnessing the potential of Islamic finance as a viable tool for financing development.

With Nigeria’s objective of achieving rapid, inclusive, and sustainable economic growth, the minister emphasized the importance of learning from the IFSB and educating oneself to make optimal use of this financing tool,” he said.

According to Edun, Islamic finance provides an additional avenue through which Nigeria can propel critical economic growth.

The minister of Finance recognises the significance of tapping into Islamic finance to fuel the economy effectively.

Edun’s address shed light on the potential advantages of Islamic finance, encouraging stakeholders to explore this alternative financing model to bolster economic growth in Nigeria.

The minister’s stance shows a commitment to expanding opportunities for sustainable development in Nigeria through innovative financial techniques.